You've reached the Virginia Cooperative Extension Newsletter Archive. These files cover more than ten years of newsletters posted on our old website (through April/May 2009), and are provided for historical purposes only. As such, they may contain out-of-date references and broken links.

To see our latest newsletters and current information, visit our website at http://www.ext.vt.edu/news/.

Newsletter Archive index: http://sites.ext.vt.edu/newsletter-archive/

1999 Wheat Situation

Farm Business Management Update, June 1999

By Dave Kenyon of the Department of Agricultural and Applied Economics, Virginia Tech

What should I do with my 1999 wheat crop? Should I store? Should I forward price? When should I collect my loan deficiency payment?

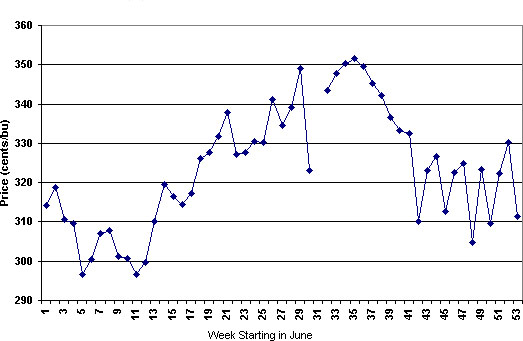

Figure 1 shows the average weekly cash wheat price in Richmond/Petersburg (RP) since 1987. On average, the harvest low occurs the first week of July and peaks in week 34, which is the third week of January. The average price increase has been 53 cents per bushel (see Table 1).

Table 2 compares the harvest low price to the third week in January price from 1974 to 1998. The average increase is 46 cents. In years when the harvest low was less $2.60, the average price increase was 75 cents per bushel. The smallest price increase was 27 cents in 1998. In years when ending stocks in June were forecast lower for the current year compared to the previous year, the average price increase was 62 cents. In 1996, the price decreased from harvest to January by 50 cents, but the harvest price was 431 cents. Storing grain unpriced when the harvest price is at historically high levels is not wise.

On June 1, 1999, RP cash price was $2.02. In May, USDA forecast 1999-2000 ending stocks at 869 million bushels, down 100 million bushels from 1998-1999. These current conditions (low harvest price and declining ending stocks) indicate 1999 may be a good year to store wheat unpriced. In similar years in the past, the average price increase has been 60 to 75 cents per bushel. Under similar circumstances, prices have increased enough to cover storage costs in all but one year. Storing wheat unpriced is risky, but the odds should be in the producer's favor in 1999.

Storing with forward pricing via futures or cash contracts is a less risky alternative. If a producer stores until January, storage costs on the farm should be about 25 cents assuming physical storage costs are 2 cents per month and interest for seven months at 9 percent is 11 cents per bushel. With a current cash price of $2.02, the breakeven price in January 2000 would be $2.27.

March 2000 Chicago wheat futures are currently trading for $2.86. The historical basis in RP in January is 20 cents under March. Hence, producers could currently lock in, via futures a January price of $2.66, a 39 cent profit per bushel compared to selling at harvest. The risk associated with this hedge is at most, 10 cents per bushel. From 1994 to 1998, the RP basis has only been wider than 30 cents in 2 out of 16 weeks. For those not wanting to use futures, a cash contract for January 2000 delivery should be available around $2.60 to $2.65. Either forward pricing via futures or cash contracts should increase producer returns 35 to 40 cents compared to selling at harvest price.

When should I collect my LDP? The national loan rate is $2.58 a bushel. Producers should check with their local Farm Service Agency (FSA) to determine the loan rate in their county. With a cash price of $2.02, the LDP would be 56 cents per bushel. To receive the LDP, producers must retain title (beneficial interest) in the grain. Producers who are going to sell at harvest must file with their local FSA before they sell the grain. Once the grain is sold, they forfeit the right to collect a LDP. Those who store their grain have until March 31, 2000 to determine their LDP. Producers should check with their local FSA before harvest to make sure they understood the LDP rules and have filed the proper forms.

The LDP is the difference between the local county loan rate and the posted county price (PCP). To maximize the LDP, the producer needs to set the LDP when cash prices are at their lowest level for the year. When will that occur in 1999-2000? Looking at Figure 1 and Table 2 show the seasonal low price usually occurs the first week of July or week 11, which is the second week of August. In recent years, the seasonal low has most often occurred the first or second week of July. Since ending stocks are projected to decline in 1999-2000 and cash prices increase compared to 1998-1999, the seasonal low should occur relatively early in the 1999 harvest season. Currently, the futures market expects prices to increase 37 cents between July 1999 and March 2000. The historical seasonal pattern, the expected cash price increase, and the current large spread in wheat futures prices all suggest the seasonal low cash price should occur during harvest this year. To be more specific, I would expect the low price to occur during late June or the first two weeks of July.

Current wheat prices are very low. Careful management of the LDP payment should add 50 to 60 cents to price. Storing with a cash contract or futures hedge should add another 35 to 40 cents without much price risk. Hence, producers should be able to improve returns by $1.00 compared to harvest price. Those producers willing to take a little more risk by storing without hedging may be able to increase returns by $1.25 or more per bushel.

Figure 1. Average Richmond/Petersburg Weekly Wheat Prices: 1987-1998

Contact the author at dkenyon@vt.edu .

Visit Virginia Cooperative Extension