You've reached the Virginia Cooperative Extension Newsletter Archive. These files cover more than ten years of newsletters posted on our old website (through April/May 2009), and are provided for historical purposes only. As such, they may contain out-of-date references and broken links.

To see our latest newsletters and current information, visit our website at http://www.ext.vt.edu/news/.

Newsletter Archive index: http://sites.ext.vt.edu/newsletter-archive/

Ethanol and Corn

Farm Business Management Update, February-March 2007

By Jim Pease (peasej@vt.edu), Extension Economist, Farm Management, Agricultural & Applied Economics, Virginia Tech

In his recent State of the Union address, President Bush called for reducing gasoline consumption by 20% in the next 10 years. One pundit noted that a reduction in gasoline consumption is a perennial goal set by every President since Nixon. In fact, US gasoline consumption has increased by double digits each of the past three decades: 1970-1980 (+13.7%), 1980-1990 (+10.0%), 1990-2000 (+17.1%). Given the nation’s increasing dependence on imported oil, the federal and state governments have assembled an impressive array of incentives to stimulate production of biofuels, with special emphasis on production of ethanol.

President Bush also called for production of 35 billion gallons of alternative fuels by 2017, dramatically above the current Renewable Fuels Standard requirement of 7.5 billion gallons by 2012. This measure will practically guarantee profitable margins for the rapidly growing ethanol industry over the next decade. US ethanol production capacity increased by 1 billion gallons in 2006, and may increase by as much as 8 billion gallons over the next two years. From 2006 sales of approximately 5.5 billion gallons, sales may increase to as much as 13 billion gallons by 2009. The President’s speech insures that demand will be waiting for the additional capacity to come on line.

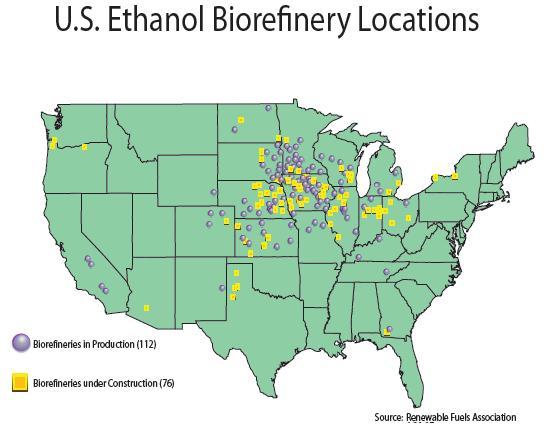

There are approximately 118 ethanol plants in production across the US, most of these located in the upper Midwest. In addition, some 72 plants are currently under construction. Corn and sorghum make up nearly 95% of feedstock for the US ethanol industry. Farmer and locally owned refineries own approximately 40% of the ethanol production capacity, Archer Daniels Midland (ADM) owns about 25%, and other companies such as VeraSun, Aventine, Cargill, and U.S. BioEnergy own about 35%. Farmer-owned refineries have declined as a proportion of total ownership, since ADM and other large firms have increased their investment in the sector. Figure 1 indicates the location of current production facilities as recorded by the Renewable Fuels Association.

Agri-Ethanol Products (AEP) is constructing a 108 million gallon per year corn-based refinery in Aurora, North Carolina and has announced construction of at least two more plants of the same size for the Virginia/North Carolina/South Carolina region. AEP has announced that these plants will consume 120 million bushels of corn per year. According to the USDA/NASS, these three states had average corn production of 166.3 million bushels over 2004-2006, and the announced plants would consume nearly three-fourths of corn production on current acreage.

The amount of the US corn crop used for ethanol production has risen from 12% in 2004, to 14% in 2005, and may reach 16-20% in 2006. Will the drive for renewable fuels production continue to drive corn markets upward? A.G. Edwards, a brokerage firm, contends in its ethanol industry outlook that ethanol demand has caused a structural shift in the corn market and has increased its 2007 corn price forecast to $3.75 per bushel. Corn for ethanol may reach 4.8 billion bushels by 2009, with over 40 percent of corn acreage destined for ethanol refineries.

A recent Iowa State Center for Agricultural and Rural Development report (http://www.card.iastate.edu/publications/DBS/PDFFiles/06bp49.pdf) states that under current incentives policy, ethanol producers can break-even at corn prices of $4.05 per bushel. Even at such a high input cost (all other prices remaining constant), ethanol refineries would be expected to produce 31.5 billion gallons per year. To provide corn for these refineries would require 15.6 billion bushels, up 4.6 billion bushels from current production and would require corn acreage to increase by 20%. The report suggests that soybean acreage may fall by as much as 8 million acres, as corn acreage increases.

Dried distilled grains with solubles will offset some of the impacts on the livestock industry. However, swine and poultry rations cannot utilize very much DDGS, and the primary livestock ration use of DDGS will be for cattle. Already there are plans for large-scale ethanol refineries in the Midwest located next to cattle feedlots, where complementarities abound.

For Virginia corn producers, high prices will encourage shifting acreage from soybeans, cotton, and peanuts to corn. The prospect of higher corn prices for poultry rations will send integrators scrambling for alternative feed ration choices. It’s a wild ride on the ethanol bandwagon right now, and the impacts on different sectors of the agricultural economy are as yet unclear.

Visit Virginia Cooperative Extension